Latest News

Mark Lister, Investment Director at Craigs Investment Partners, reports GDP growth, and positive news in agriculture, but a subdued local housing market.

It’s been a steady first half of 2025 for the New Zealand economy, although the long-awaited recovery hasn’t arrived with the vigour many would’ve been hoping for.

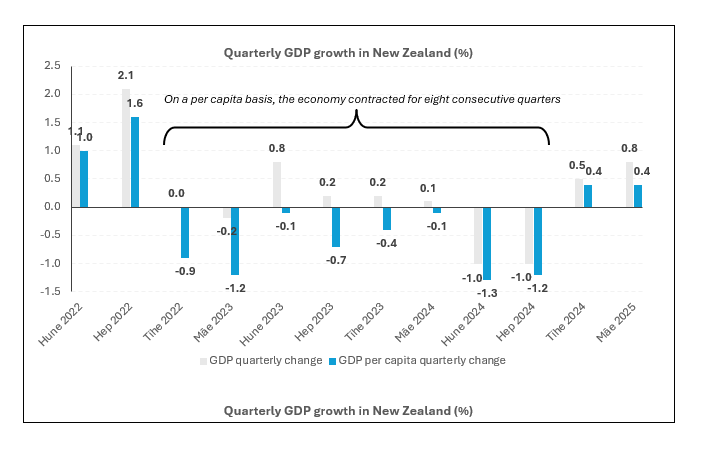

Gross domestic product (GDP) for the March 2025 quarter was stronger than expected, rising 0.8% on a quarterly basis. That was ahead of Reserve Bank of New Zealand (RBNZ) forecasts for 0.4%, while it was also slightly above economist estimates for a 0.7% gain. Per capita growth was 0.4%, the same as the previous quarter, after eight consecutive quarters of contraction before that.

As encouraging as this is, under the surface conditions are mixed and the likes of construction, hospitality and retail remain under pressure. We haven’t yet seen the housing market fire either, which has kept consumer confidence in check.

May sales volumes were up 6.4% on the previous month and 8.9% higher than the same month a year earlier. However, the number of days to sell has trended higher and national prices have fallen in five out of the past six months.

The median sale price in Tauranga is up 2.1% over the past 12 months, a better performance than the national average but still a very subdued increase. Affordability remains a significant challenge across the city, and this is likely to remain a headwind to further rises.

A bright spot for the domestic economy is agriculture, with the Fonterra payout for the recently ended dairy season hitting a new record high of $10.00. That exceeds the previous high of $9.30 from a few years ago, and it bodes very well for many of our rural economies. While Fonterra has offered a relatively wide range for the 2025/26 season, it has a midpoint forecast of $10.00 again this year as well.

Here in the Bay of Plenty, a strong kiwifruit harvest and solid prices are providing support to spending and orchard gate returns. At the same time, many other sectors remain under pressure.

Sluggish activity has impacted the labour market, with unemployment across the broader region rising to 5.9% in the March 2025 quarter (from 4.8% at the end of 2024). While the unemployment rate is far from a perfect measure of labour demand, this is the highest in seven years.

One positive sign for the balance of the year is that lower mortgage rates will be helping households. The one-year rate is now below 5.0%, well down from 7.3% 18 months ago. That will take immense pressure off family budgets, although we’re approaching “as good as it gets” territory on the interest rate front.

The Official Cash Rate (OCR) has declined to 3.25%, well down from a peak this cycle of 5.50%. However, interest rate markets are betting on just one final cut from here. The RBNZ is tipped to pause at its July meeting, before reducing the OCR one final time in August, October or even November.

If that is indeed the last cut this cycle, it would see the OCR troughing at 3.00%.

The information in this article is provided for information only, is intended to be general in nature, and does not take into account your financial situation, objectives, goals, or risk tolerance. Before making any investment decision, Craigs Investment Partners recommends you contact an investment advisor.