Latest News

Mark Lister from Craigs Investment Partners notes global markets are stabilising, while at home, we’re still facing challenges, including a weaker than expected GDP. Moving into the last quarter, falling interest rates are one of the early positive signs beginning to emerge.

This year has been a mixed bag so far, and there’s been significant divergence between the international picture and what we’ve seen here at home.

Globally, there was huge uncertainty in the wake of US President Donald Trump’s tariff announcements in April. However, financial markets have stabilised and recovered since then, and some positive tailwinds have become more evident in recent months.

International markets have proved resilient

The global economy has proved resilient, corporate earnings growth has come in stronger than expected, while concern over trade tensions has eased somewhat. US tariffs are much higher than they were a year ago, but they aren’t as bad as the worst-case scenarios and at least we know where we stand.

An agreement between the US and China remains unresolved, with two consecutive three-month extensions to the deadline so far. The latest of these will expire in mid-November, so that’s something to watch closely in the upcoming quarter. An undesirable outcome could derail the upbeat tone, so let’s hope the reprieve reflects productive negotiations taking place behind the scenes.

In September, we also saw the US Federal Reserve – the world’s most influential central bank – cut interest rates for the first time this year. Further reductions are expected, which will hopefully support economic activity and provide a stable backdrop in the world’s biggest economy.

The local economy remains challenged

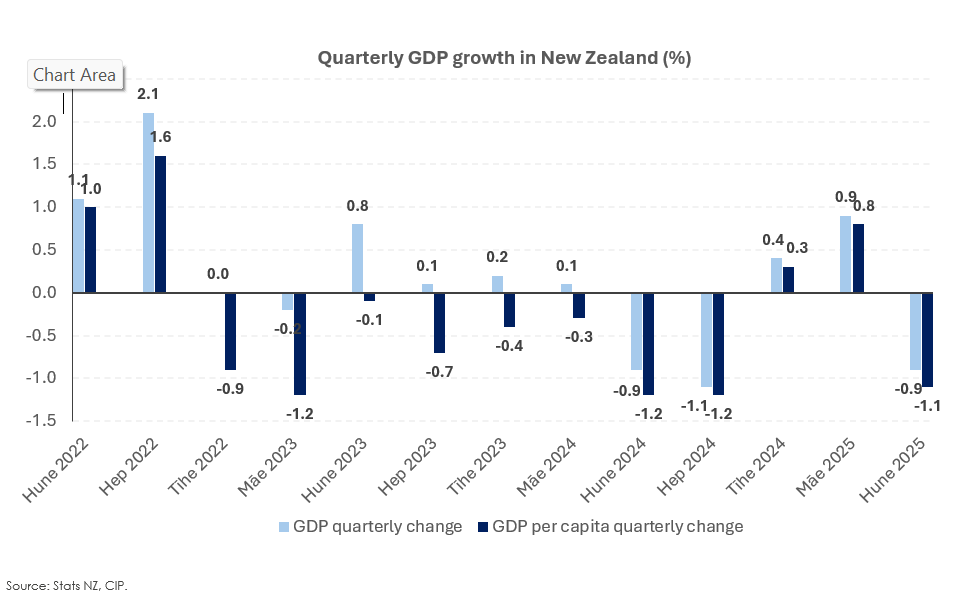

Locally, it has been a more challenging period. New Zealand’s gross domestic product (GDP) for the June 2025 quarter was much weaker than expected, falling 0.9 per cent on a quarterly basis. That was weaker than Reserve Bank of New Zealand (RBNZ) and market forecasts for a 0.3 per cent decline. This report is somewhat dated (covering April, May and June) and more recent indicators point to an improvement, but it highlights just how long and deep the recession has been.

On a per capita basis, the economy has contracted for eight out of the last 11 quarters. This weakness has been felt most in economically sensitive sectors like construction, retail and hospitality – agriculture has fared much better.

Help is on the way (in the form of lower interest rates)

The Official Cash Rate (OCR) has been reduced to 3.00 per cent, well down from the 15-year peak of 5.50 per cent that prevailed just over a year ago. The RBNZ meets next week, and another cut of 0.25 per cent is assured. There’s also a chance we see a larger 50-point cut, if the Bank chooses to act decisively and proactively. Financial market pricing is only ascribing about a 20 per cent probability of that, but three of the five major banks are picking it. If they’re right, we’ll head into Christmas with mortgage rates a touch lower and (hopefully) a pickup in confidence and activity.

We also need to remember that it takes time for monetary policy changes to make their way through the economy. Mortgage rates are comfortably below 5 per cent now, but (on average) borrowers are still paying some 0.50 to 0.75 per cent above that. Most of us fix our mortgages, so when the OCR falls or banks reduce mortgage rates, we don’t benefit from those lower costs right away.

A steady stream of mortgages moving onto lower rates will hopefully boost activity and spending, putting businesses in a stronger position and giving them the confidence to grow, hire and invest.

A weaker NZ dollar will support exporters too

A byproduct of the weaker growth picture and expectations for more aggressive monetary policy easing has come in the form of a lower currency. The NZ dollar has slipped against most trading partners in the past three months, falling 4-5 per cent against the US dollar, Australian dollar and the British pound.

This is supportive for exporters as it makes them more competitive on the global stage, while it might also make us a more attractive destination for tourists. At the same time, a weaker currency can increase the price of imports, putting upward pressure on tradables inflation.

It’s an important shock absorber for our economy though, and the positives should outweigh the negatives over the coming period. Keep an eye on things like card spending or freight and traffic indicators in the months ahead, as well as business and consumer sentiment surveys. That’s where signs of a rebound could show up first.

It might take a little more time, but 2026 should be a much better year than the last three have been.

Mark Lister is Investment Director at Craigs Investment Partners. The information in this article is provided for information only, is intended to be general in nature, and does not take into account your financial situation, objectives, goals, or risk tolerance. Before making any investment decision Craigs Investment Partners recommends you contact an investment adviser.