Latest News

Jon O’Connor from Bayleys offers a positive outlook for the region’s property market, noting confidence is returning for the right reasons.

If the last couple of years have felt like the property market’s been sailing in a stiff headwind – sails trimmed, progress slow and everyone keeping a close eye on the forecast – you’re not alone. Volatile interest rates, tighter lending and a general ‘maybe we’ll just wait and see’ mindset have made buyers more careful, sellers more realistic and conversations focused on the OCR.

As we move into 2026, the tone is warmer. Not in a ‘back to boom’ way – more in a ‘people can make plans again’ way. And for the Western Bay of Plenty, this is supported by more than just interest rates: we’ve got momentum in amenity, transport, education and a stronger regional growth plan that aims to bring more certainty to how we deliver housing and infrastructure. The result is a more positive outlook for residential, commercial and rural property – grounded in substance rather than hype.

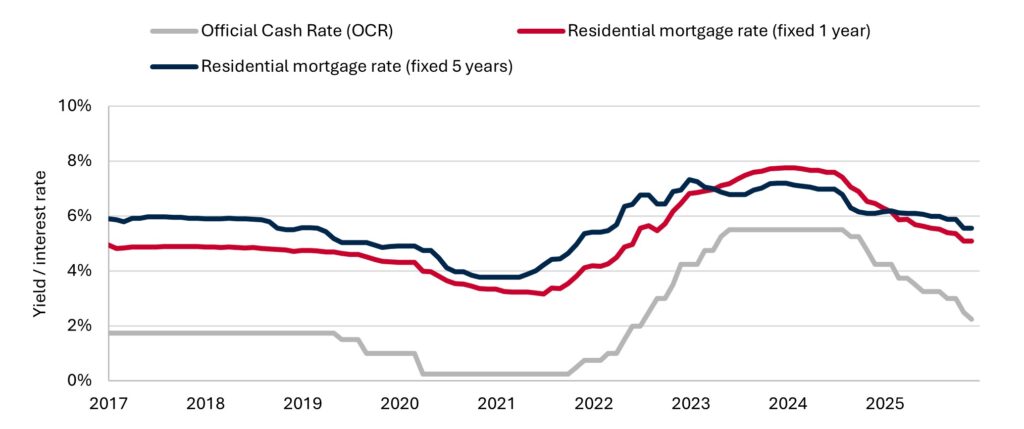

The big macro change is that the interest-rate cycle has changed gear. Home loans rate reduced around 1% over 2025. These lower rates have helped to take the edge off borrower anxiety and brought more certainty into budgeting. In most cycles, activity returns before big price movements, and that’s the pattern we’re starting to see again.

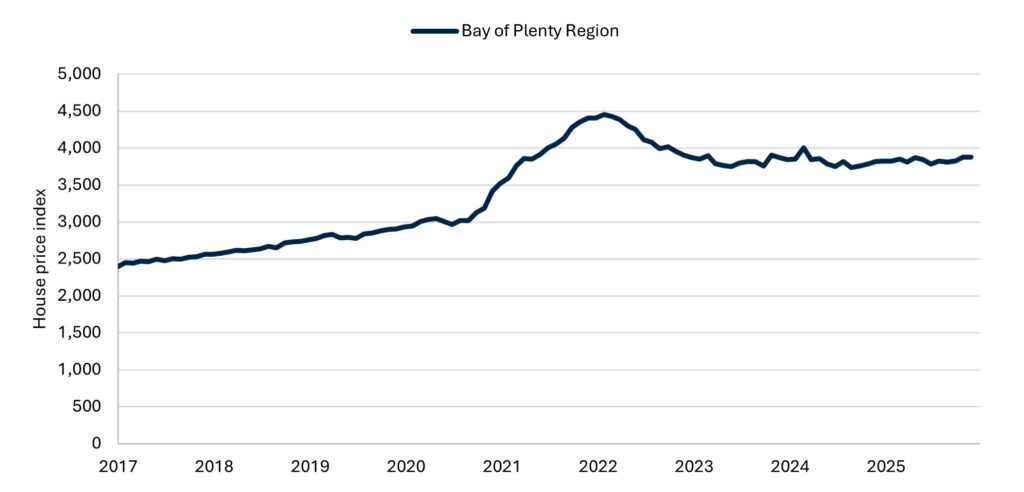

At the coal face of the housing market, sales are back around long-run averages, but prices have remained relatively stable. The local house price index has lifted by about 1% over the past 12 months. While lower interest rates have helped drive activity, rising vendor confidence has also pushed the number of homes for sale to more than 2,200 across the Bay of Plenty – around 30% higher than the long-term average at the end of 2025. In short, buyers are more confident thanks to lower borrowing costs, but they also have more choice, which is keeping price growth contained.

It’s also worth keeping one eye on jobs, because job security and confidence are tightly linked. A market with a bit of caution tends to be healthier: better due diligence, more sensible pricing, and fewer decisions made out of panic or hype. When confidence lifts, it ripples through the local economy – spending, renovations, leasing decisions and investment – and property is part of that story.

A key difference this cycle is that it’s as much about supply as demand. Building pipelines have been lifting again, and while consenting isn’t the same as completing, the direction matters. Feasibility and funding still bite, but the likely outcome is a gradual lift in supply – enough to add choice, without suddenly transforming the market overnight. In other words, a measured recovery.

And the local story is simple: supply only arrives when planning, funding and infrastructure line up – and across the region, that alignment is improving. We’ve got an encouraging mix of greenfield growth and inner-city intensification that should materially lift housing supply over the coming years. Ōmokoroa continues to progress under a coordinated structure plan approach and Tauriko West is shaping up as one of the region’s most significant new communities, supported by new centres, reserves and community facilities, and enabled by key transport works. To the east, Pāpāmoa East and Te Tumu remain major growth engines.

At the same time, Tauranga’s Plan Change 33 is helping to bring more homes closer to jobs and amenities by enabling intensification and a wider range of housing types in and around the city centre. We’re already seeing that shift to inner-city living with the newly built Elizabeth Towers, which broadens housing choice – for downsizers, professionals and anyone wanting a lock-and-leave lifestyle – and supports a healthier market through greater overall supply.

The Western Bay of Plenty also continues to benefit from strong underlying demand drivers. We’ve always had lifestyle pull – beaches, climate, outdoor living and a strong community feel. What’s changed is that we’re maturing as an economic region with deeper anchors. Tauranga sits in a strategic catchment of the ‘Golden Triangle’ that connects New Zealand’s largest capital pool in Auckland, Waikato’s growth, and our own role as a logistics and lifestyle centre.

Lifestyle migration remains a long-term theme too, with many households seeking a more balanced way of living. When national confidence improves, the WBOP often benefits early – especially from buyers bringing equity and long-term intent. Add holidaymakers and second-home buyers into the mix, and you get a region that attracts both homeowners and investment capital for enduring, lifestyle-driven reasons.

Locally, we’re also seeing real momentum in Tauranga’s city centre transformation, one of the more encouraging stories. Te Manawataki o Te Papa (the civic precinct) is designed to lift everyday amenity and create more reasons to spend time in the city centre. Amenity matters because it changes behaviour: a centre that’s enjoyable and useful supports hospitality and retail, improves office appeal, and strengthens the long-term case for well-designed urban living.

Then there’s the less glamorous but hugely important category: transport. Projects such as Takitimu North Link and the Tauriko enabling works are about reliability, safety and access – the unsexy stuff that quietly reshapes where people choose to live and where businesses choose to invest.

A quieter tailwind – but a meaningful one – is tertiary education. The University of Waikato’s Tauranga presence continues to support the city centre growth story. Over time, student and staff demand tends to be “sticky”, feeding into rentals and smaller dwellings in the right locations, and adding depth to the urban economy.

Another encouraging development is the region’s push for a Regional Deal partnership with central government. The intent is stronger long-term alignment around how the region grows, including more housing, more jobs, improved access to essential services, and new funding and financing tools to help deliver the infrastructure growth requires. For property, it’s the certainty angle that matters: certainty drives confidence and confidence tends to unlock investment.

There are still a couple of timing questions to keep in mind. Investor behaviour can be more cautious when policy settings are being debated, and some landlords may choose to sell and simplify if returns are mixed. Election-year uncertainty can also cause a mid-year pause while people wait for clarity, although activity has typically picked back up quickly after.

So what does all of this mean on the ground in 2026? We’re seeing improving enquiry and steady activity as confidence returns. In residential, quality and location should continue to be rewarded first, while buyers remain value-conscious. In commercial and industrial, the WBOP fundamentals of logistics, growth and connectivity provide a supportive base; industrial looks resilient while office and retail remain more selective.

Overall, 2026 is shaping as a more positive year for property in the Western Bay of Plenty – not because we’re racing back to peak frenzy, but because the foundations are improving in a sensible way. After a period of stiff headwinds, it feels like the breeze is easing and the course is clearer with more comfortable conditions to sail into.

Jon O’Connor is the Bayleys Residential Sales & Projects Manager in the Bay of Plenty.

For more business news & views, sign-up to Priority One’s fortnightly newsletter here.